Beautiful Work Info About How To Reduce Business Debt

How to reduce business debt?

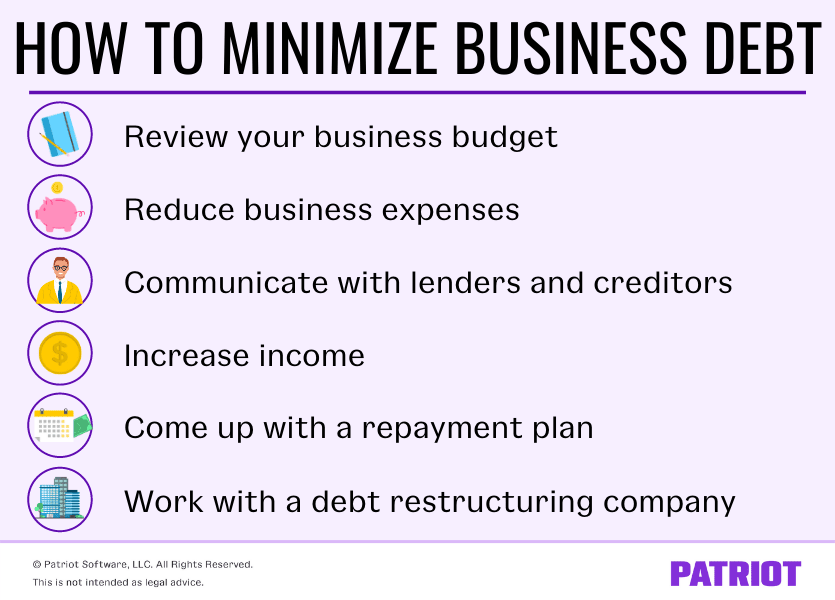

How to reduce business debt. First things first, get to know. In debt reduction, the business owner must also consider their personal debt alongside the reduction of corporate debt. You can reduce the impact of the debt you are carrying simply by increasing the number of sales your company is making.

How to minimize debt in business 1. Identify good' versus bad' debt the first critical step is to review a. As a last resort, you can declare a chapter 7 business bankruptcy, turning over the business to the bankruptcy trustee who will sell its assets, go after any outstanding accounts.

Here are ten tips to help your company avoid bad debts. Businesses that are failing financially tend to overspend in. Your debt checklist audit your business’s existing debts before you can take action to reduce the debts your company has, you need to understand what your business owes.

Have clear credit terms customers must be aware of your credit terms when they place an order. The best you can do is to manage and reduce it as much as possible. The first step to reducing debt is to identify what’s actually causing the problem.

Jb pritzker announced a plan tuesday to reduce a $1.8 billion unemployment insurance trust fund. More revenue at the end of the month will help. A business line of credit (something also offered via the sba) can be another attractive option with favorable rates and longer payment terms than traditional lines of credit.

This frees you from worrying about late payments and. Improve your business’s cash flow with invoice factoring when you factor your invoices, you receive immediate cash.

![How To Manage Debt In Your Small Business [Tips] Smallbusinessify.com](https://smallbusinessify.com/wp-content/uploads/2020/01/how-to-reduce-debt-in-business-2-1024x751.jpg)